Published by Jeremy. Last Updated on June 10, 2024.

Disclaimer: This post contains sponsored content. This Week in Blogging uses demographic data, email opt-ins, and affiliate links to operate this site. Please review our Terms and Conditions and Privacy Policy.

We're always on the lookout for new travel affiliates and products to help generate revenue on our travel blogs.

One company that has been making waves in recent years is Stay22, a 3rd party affiliate company with unique blogging tech like maps with live API pricing of hotels, optimized redirects, generous payout terms, and, as of early 2023, a unique pop-up tool aptly known as Nova (formerly called POP and renamed in mid-2024).

I put the Nova tool to the test on three of my blogs with travel content, and after collecting a year of performance data, I was truly shocked at what was found. This one product from Stay22 helped increase our annual revenue by $6,600- roughly doubling our hotel earnings in just a few minutes of installation work!

So in this one, I thought I'd share more about the Nova tool from Stay22, my performance data over the 12 months monitored, and draw a few conclusions about how Nova influenced my earnings.

Notes: I installed the scripts for Nova on January 13th, 2023. Data referenced as 2023-2024 follows 12 months starting on this date and does not account for any optimization time that may be present shortly after installation. Likewise, any data reported from the previous year, labeled 2022-2023, uses January 13th as the reference point- not calendar year, despite being fairly close. Other discrepancies or estimates will be noted when relevant. Finally, this article was sponsored by Stay22; however, all data points and expressed opinions are my own.

What is Stay22's Nova Feature?

Stay22's Nova tool is part of their umbrella brand of “Let Me Allez” (or LMA) products that use scripts and AI to help optimize your earnings. These can include optimized redirects, triggered popups, and more.

As its name implies, Nova is the triggered popup product within this umbrella.

The way it works is simple. When a user visits your site, Stay22's proprietary algorithm will determine if your reader will likely book a travel-related product soon. This could be a hotel, flight, car rental, activity, or more. If they meet a set of conditions, a popup will appear in a new browser to open a booking page for the user.

This booking page subtly pushes users to complete the purchase they likely have already considered. If they make a purchase, you get the commission. If not, most services drop a cookie, so you may still be credited for a sale if completed within the cookie window (3rd party service dependent, of course).

The trick with Nova , so as not to overwhelm users, is that it is only triggered once every 40 days across all sites that use Stay22's script. So, if your site triggers a popup, and they move on to another Stay22 partnered site, a Nova is unlikely to trigger. As such, the opportunity for commissions is increased dramatically due to this limited-yet-targeted approach.

So, now that we're all on the same page with how Nova works, let's get into the details of how it helped us make an extra $6,600 in the first year!

- Note: Currently, there is no way to force a Nova to trigger to see what it looks like, but Stay22 has an example graphic on their site. I've only seen it appear on my sites a handful of times when browsing myself. That said, I have not received a single complaint in several million page views across three sites!

Nova Increased Our Affiliate Earnings by $6,600

To determine how much Nova changed our overall earnings, particularly around hotel commissions, we looked at our total earnings across all networks and services we promote hotels from. This includes affiliate networks and/or booking platforms like Stay22, CJ (IHG), Booking.com, and Partnerize (Marriott). This was done to have a reference point across all hotel bookings on our sites, not just Stay22 hotel bookings.

It is worth noting that Nova can also contribute to the sales of flights, car rentals, and activities, not just hotels, where other services may not. We sell these affiliates in other sources that were not tracked for this analysis but kept this data in our Stay22 totals as these conversions were generated by the Nova tool outright.

One issue with this approach is that while our non-hotel product earnings from Nova were nominal (~$290 in 2023-2024, or about 2% of our total earnings), the overall number of bookings in this category was significant (~181, or almost 14.5%). As such, calculations for average commission per booking may be lowered ever-so-slightly. The estimated difference will be noted when relevant.

With these caveats, let's jump into it.

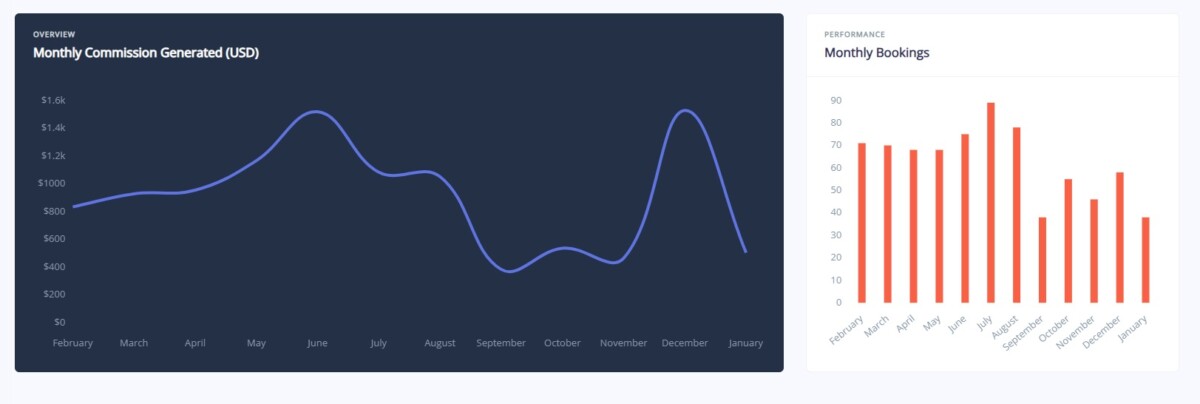

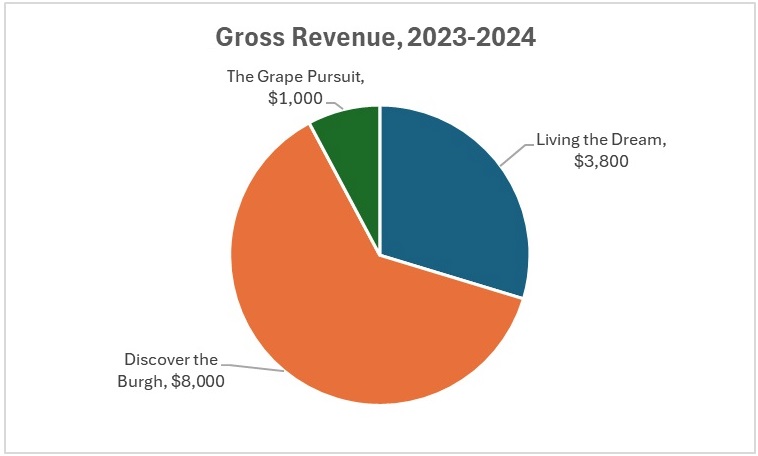

In 2023-2024, after installing Nova , our total affiliate revenue from the above set of services was approximately $12,800. This was across 1,242 bookings and three websites. Our average commission was $10.30 per booking, including non-hotel products sold via Nova links (we estimate an average closer to $11.80 per booking with non-hotel products removed).

We originally wanted to compare this data to our 2022-2023 performance overall, but in looking at the data sets, we concluded that there was far too much variability in deep link performance YOY to draw any accurate comparisons. Our gross revenue was up, but the data was simply all over the place in that regard.

Instead, we simply want to pull out our Nova data from 2023-2024 for further discussion here. We can do this because the LMA suite of tools includes tracking tags on Stay22's dashboard that we can reasonably attribute to Nova. As such, in 2023-2024, we can reasonably state that $6,600 of the above earnings were attributed to the Nova tool.

This amounted to about 51% of our 2023-2024 earnings overall! This was across 630 bookings and three websites, including virtually all of the non-hotel products mentioned above. Our average commission on Nova-only bookings was $10.52 per booking, including the non-hotel products also sold (we estimate an average of closer to $14.00 per booking with non-hotel products removed here).

So, what does this all mean? We can break out some data for further analysis and to draw some conclusions.

Analyzing the Data a Bit Deeper

First, as mentioned above, Nova accounted for roughly 51% of our revenue from Stay22 in 2023-2024. This is, in a word, huge. Turning this one on in just a few minutes of work had, without a doubt, our biggest return of the year across the board.

Doubling earnings in a calendar year just because of Nova ? Yes, please!

Digging deeper, it is hard to conclude whether Nova helped increase our average commission per booking. The non-hotel products certainly influence the averages considerably, we'll be the first to admit, and after removing them for calculation purposes, it does seem like Nova had an increase in average commission of about $2 per booking of hotels only. However, this could also heavily depend on other variables we cannot measure (e.g., market forces, shifting article rankings, etc.).

So, while we can confidently say Nova had a stellar increase in our total bookings and revenue, we believe the average earnings-per-booking were comparable to what we see with deep links. This was, in all honesty, what we expected at the start of this analysis.

Second, our hotel cancelation rate was 23% across all services in 2022-2023. The next year, our cancelation rate was 19.1%. Looking at Nova bookings only, we had a cancelation rate of 18.9%. The significant cancelation rate across all services likely contributed to about $2,500 in lost revenue in 2023-2024.

While this looks like there may not be that much of a difference in cancelations year-over-year or with Nova outright, when we broke cancelation rates out on a site-to-site basis, we saw something interesting for 2023-2024:

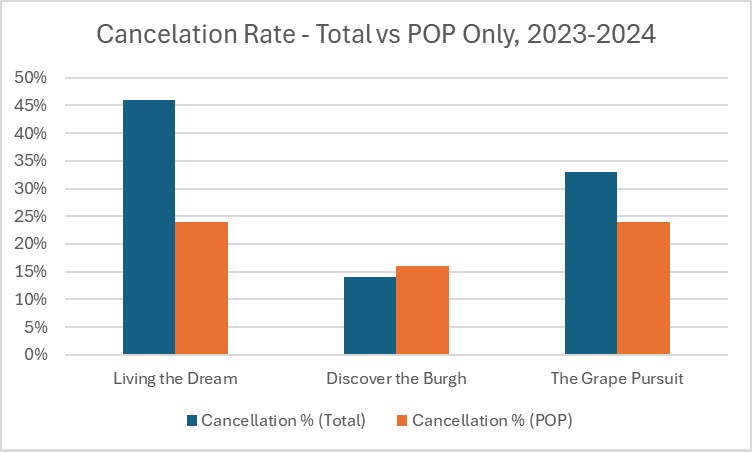

- Living the Dream, our global travel blog, had a 46% cancelation rate on deep links (all programs) and a 24% cancelation on Nova (Stay22 only).

- Discover the Burgh, our local destination blog, had a 14% cancelation rate on deep links and a 16% cancelation rate on Nova .

- The Grape Pursuit, our wine blog, had a 33% cancelation rate on deep links and a 24% cancelation rate on Nova .

Regarding cancelation rates on individual websites, Nova performed much better than deep links on our two sites with more global travel content. This could indicate that Nova is getting the job done by targeting the right user at the right time or with the right booking company! We also looked at this data on individual programs (e.g. Booking or Expedia), and it held fairly consistently across the board- Nova had a notable drop in cancelations.

Our local site was an outlier here, and our cancelation rate is more or less the same between deep links and Nova in the tracked data.

Part of this could be that our booking window on the local site is much shorter. People generally don't plan a trip to Pittsburgh six to twelve months in advance and instead book days or weeks out. We even get many day-of bookings, too! Likewise, many overnight bookings are from regional visitors who may just be visiting the city only and not traveling on a larger and/or longer itinerary- the need to change bookings to suit an itinerary adjustment seems far lower. As such, this cancelation data makes a bit more sense.

Although this is purely an estimate, the reduced cancelation rates due to Nova likely increased our overall revenue by about $500-$1,000 in 2023-2024.

- Note: It is hard to calculate potential income (gained and lost) around cancelations if only because services are all over the place in reporting. Some show the commission value despite being canceled, others show $0, and some even show an additional line item with a negative adjustment balance to compensate. We accounted for many of these variations when performing our analysis, but for the bookings that showed a $0 value, we simply have no clue how much potential revenue was lost. As such, any revenue commentary here is merely an estimate.

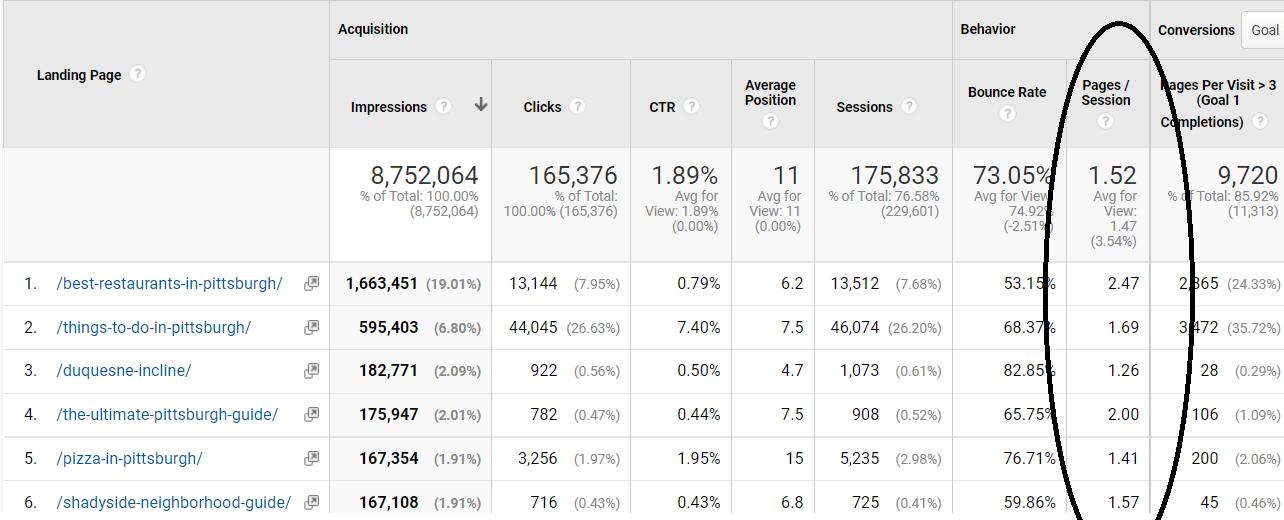

Third, it is worth highlighting that our sites received just over 3,000,000 total page views combined in 2023-2024.

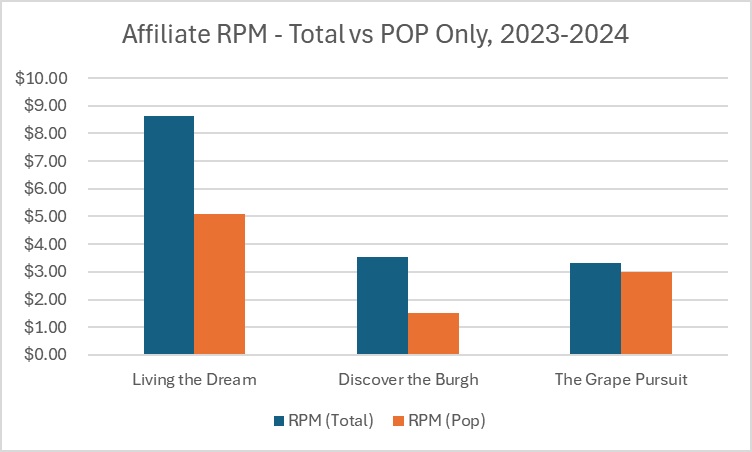

On an RPM basis (earnings per 1,000 page views), we earned about $4.25 RPM in 2023-2024. Extracting only the Nova data, we calculate that it contributed $2.20 RPM to that total in 2023-2024.

We can also look at the data split between our three sites as well, and our breakouts for 2023-2024 with Nova enabled are as follows:

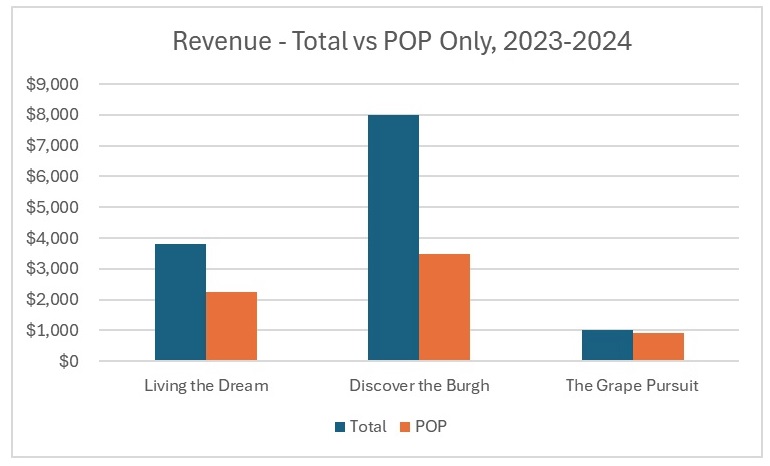

- Living the Dream, our global travel blog, received 440,000 page views. We made approximately $3,800 on this site in affiliate bookings, with $2,248 of the total value from Nova (59%). The total RPM on a pageview basis was $8.63, with Nova contributing $5.10.

- Discover the Burgh, our local destination blog, received 2,275,000 page views. We made approximately $8,000 on this site in hotel affiliate bookings, with $3,470 of the total value from Nova (43%). The total RPM on a pageview basis was $3.52, with Nova contributing $1.52.

- The Grape Pursuit, our wine blog, received just under 300,000 page views. We made approximately $1,000 on this site in hotel affiliate bookings, with $909 of the total value from Nova (91%). The total RPM on a pageview basis was $3.33, with Nova contributing $3.

We can break this down a bit more.

Our global travel blog had the highest RPMs of our three sites, which, in all honesty, was a bit expected simply because we target travelers on this site almost exclusively. If they travel, they will naturally need to book affiliated products at some point. We view this one as simply casting the widest net amongst our three sites.

We had 365 bookings, with 68% coming from Nova . This means that Nova contributed a sale once every 1,800 page views (or about 1.5 days at average traffic).

- Takeaway: Topically, this site is the most suitable for Nova (and hotel bookings at large), and it just needs more traffic to yield higher overall earnings. That said, a high Nova percentage on a targeted site like this could suggest we have room to improve on deep-linking hotels, too. This is based partly on the results we saw on our other blogs, which we will discuss further.

Our local blog had the highest overall earnings of our three sites because it gets the most traffic by a long shot. Locals mostly read this site (upwards of 75% live within what we'd call driving distance), so the opportunity for bookings is lowered considerably but is still offset by overall volume. That said, we did notice several sales from locals looking to book travel outside of the city (via Nova data), so even those local could still be targeted here to an unknown degree.

We had 797 bookings, with 38% coming from Nova . This means that Nova contributed a sale once every 7,400 page views (or about 1.2 days at average traffic). If our estimate that 25% of our audience are visitors who possibly need a hotel is accurate, then the booking rate via Nova tracks almost perfectly with our global travel blog (~1,850 visitor page views generate a booking). The element of locals booking travel outside of the area is not factored into this calculation. We do not know the split of Nova performance in this regard, so this analysis could be skewed a bit.

- Takeaway: This site could likely earn more by having more overall content targeted to visitors over locals, which is something we recognize we could improve on. Likewise, the lower Nova percentage rate here suggests that we do a good job on hotel deep links on content visitors read and perhaps have an opportunity to emulate this on other sites.

Our wine blog is an outlier here, if only because travel content is a slim percentage of our overall traffic and was also a lot more variable in 2023-2024. That said, this one had healthy hotel affiliate revenue from Nova .

We had 80 hotel bookings, with 88% coming from Nova. This means that Nova contributed a booking once every 4,225 page views (or about 5 days at average traffic). However, if we consider that a small percentage of our site features travel-oriented content (those who are reading wine reviews probably aren't actively booking hotels- much like locals in Pittsburgh), then the estimated number of page views on travel content only would theoretically drop a great deal- possibly close to (or better than) the 1,800 figure quoted for the previous sites.

- Takeaway: Data for this site is still hard to judge because travel is a small subset of the overall traffic, and the site has had a fair bit of volatility over the last year. There is a lot of money in wine tourism, but we're just starting to tap into it. That said, the highest Nova booking rate of the three sites suggests we could do better at deep linking in travel content overall. Nova really is carrying the sales here. More travel content and more deep links will likely lead to greater profit. We just need to work to make travel a bigger part of this site than it is now.

Suffice it to say, the main takeaway we have here is that Nova has worked quite well across the board on all three of our sites but was disproportionately higher on our travel-oriented websites than our local blog, which is something we expected purely from the visitor vs. local split as discussed above.

Overall, while a lot of the above discussion was simply to highlight some interesting observations we have seen in our data using Stay22's Nova tool on our sites, at the end of the day, we go back to the fact that we made $6,600 from the tool in 2023-2024. This is money we likely would not have made otherwise, and for that we are quite thankful for the product!

Are you looking to increase your travel affiliate revenue with Stay22? Our friends at the network are offering new subscribers a 5% bonus in base commission after signing up via our link! Additional terms and conditions may apply. This offer is only available for new members to Stay22. Looking to get more out of Stay22? Be sure to download our Stay22 handbook (PDF) with everything you need to know about the network!

Join This Week in Blogging Today

Join This Week in Blogging to receive our newsletter with blogging news, expert tips and advice, product reviews, giveaways, and more. New editions each Tuesday!

Can't wait til Tuesday? Check out our Latest Edition here!

Upgrade Your Blog to Improve Performance

Check out more of our favorite blogging products and services we use to run our sites at the previous link!

How to Build a Better Blog

Looking for advice on how to improve your blog? We've got a number of articles around site optimization, SEO, and more that you may find valuable. Check out some of the following!